According to the report, vendors will lose out on over 75% of the potential market for CRE over the period, with video service providers preferring to develop their own recommendation engines.

The Content Recommendation Engine (CRE) market will expand to $1.6bn by 2027 as vendors lose out to in-house deployments, according to a new report titled Content Recommendation Engines Forecast 2022-2027 by Rethink TV.

On a per-user basis, the total addressable market (TAM) for Content Recommendation Engine (CRE) software will grow from $4.2bn in 2022 to $6.3bn in 2026.

This will be driven by a rapid expansion in the number of video users. As viewing habits fragment across a range of video services, each platform will have to invest to prove its worth to non-committal, over-subscribed users by recommending attractive content from the get-go. Equally, pay-TV operators will have to spend more to become efficient aggregators of OTT content if they have any chance of slowing the inevitable customer exodus.

CRE is often referred to as recommendations, at a general level, but the guts of the technology consist of the engine itself – which discerns patterns in user data and preferences to make personalised content recommendations. Rethink TV has defined CRE as software that is solely responsible for recommending content titles based on a user’s profile.

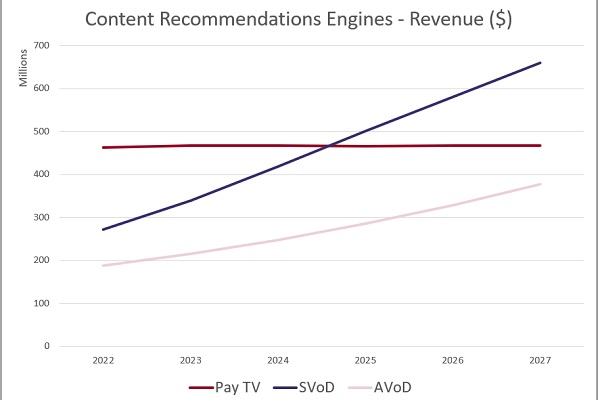

The report finds that vendors will effectively lose out on over 75% of the potential market for CRE over the period, with the largest video service providers preferring to develop bespoke, in-house recommendation engines. In 2022, the Service Obtainable Market (SOM) for CRE is just 23.19% of the TAM, at $969m, and by 2027, this share has barely grown to 24.82% – a SOM of $1.6bn.

Tier 1s have the capex available to invest in in-house development teams, and with many viewing CRE-based personalisation as a key to fighting churn, it is no surprise that many large operators opt to keep this work internal.

This growth will be even more substantial, were it not for the commoditization of recommendations, as it is bundled into a wider suite of personalisation tools alongside UX/UI, marketing, Content Management Systems (CMS) and advertising technologies. While it was a miracle technology ten to fifteen years ago, recommendations have now become an essential technology for anyone looking to keep users engaged with their service.

Vendors have clocked on to this natural grouping – most will not sell CRE as a standalone technology, as metadata enrichment or other personalisation tools are now usually thrown in to augment the offering. This consolidation of services has devalued CRE as a standalone technology, a trend that we believe will steepen over the forecast period.

The average price of CRE will, therefore, completely plateau during our period at around $0.82. This is despite widely anticipated improvements in the decisioning capabilities of such engines, fueled by further training of AI and ML.