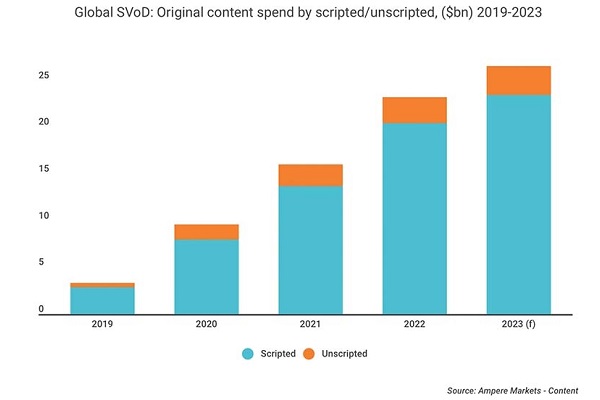

According to the report, the vast majority of original content budgets of global streamers so far continue to go into scripted fare.

Streamers will spend $26.5 billion on original content in 2023, up $3.3 billion, or 14%, from $23.2 billion last year, according to a report from research firm Ampere Analysis.

Scripted TV series remain the focal point of investment in original content, with almost 90% of SVOD commissioning spend channelled toward high-budget Scripted shows.

Crime and thriller titles command the largest share of budgets, with 24% of original spending allocated to returnable crime thrillers that appeal to subscribers across age groups and are highly portable across borders. Additionally, sci-fi and fantasy receive a significant share of original spending, with titles such as Netflix’s Stranger Things and The Witcher, as well as Disney+’s franchise spin-offs driving consumer engagement and subscriber acquisition.

With Netflix and Disney+ spending 26bn dollars this year, following a 45% rise in 2022, Ampere Analysis estimates the industry will be focused on selectivity and austerity. Despite the growth in unscripted content, scripted fare remains the industry’s top spender.

Ampere analyst Neil Anderson noticed that in 2021, scripted content spending hit $13.7bn, with unscripted accounting for $2.3bn. In 2023, those numbers are expected to hit $23.4bn and $3.1bn respectively.

“While scripted programming remains the bedrock of investment, there has been recent growth in unscripted commissioning, with the number of unscripted projects from global SVODs [streaming video on demand] rising by 35% in 2022,” Anderson said. “Growing unscripted commissioning activity has not resulted in a redirection of spend.”