In 2022, the APAC SVOD sector (excluding China) is expected to grow by 25% year-over-year to $12bn.

The Asia Pacific online video industry revenue will grow by 16% year-on-year in 2022 to reach $49.2bn, according to the new report titled Asia Pacific Online Video & Broadband Distribution 2022 by Media Partners Asia (MPA).

The study forecasts online subscription video-on-demand (SVOD) will grow by 19% in 2022 to $24.6bn in revenues with China contributing 51%. Apart from China, the Asia Pacific SVOD sector is set to grow by 25% year-on-year to $12.0bn in 2022. SVOD revenue is projected to reach $19.1bn by 2027 in APAC ex-China and $36.5bn with China.

Commenting on the findings of the report, MPA executive director Vivek Couto said: “Investors are increasingly focused on enhanced scale, improved monetization and real profitability across global, local and regional online video platforms. In this context, the role of Asia Pacific continues to have a critical role in the future of the global online video industry. The region remains the largest growth contributor to global online video customers and users today and is emerging as a significant contributor to revenue growth. With the US and Europe fast maturing and China inaccessible, APAC’s large markets – India, Indonesia, Japan, Korea and Thailand – will be increasingly important to global platforms. Each of these markets requires local content and distribution strategies with long-term investment.”

China, APAC’s largest market, will generate $11.2bn in revenue in 2022, representing 48% of the APAC online video revenue pie. Two long-form platforms Tencent Video and iQIYI, and two short-form video players ByteDance and Kuaishou lead, will capture ~70% of China’s online video revenue in 2022. Despite regulatory hurdles and market maturity, China will remain APAC’s largest online video market, growing at a CAGR of 5% over 2022-27 to top $30bn or 42% of the APAC online video revenue pie, by 2027. China’s online video market is insular and largely closed to international streamers.

Australia is a high revenue generating online video market. SVOD has reached maturity with household penetration at 85% in 2022, higher than even the USA globally.

Japan and Korea house high-ARPU and relatively high-CPM audiences, with significant growth potential as SVOD penetration of households are not yet saturated at 49% and 42% respectively. Content from Japan and Korea have proven global travelability, allowing local content investment to be monetised internationally by multi-market players. Ex-China, Japan is APAC’s largest OTT revenue market, generating $9.7bn billion in 2022 and forecast to grow to $14.7bn by 2027.

India’s streaming OTT video market is in its second growth phase with total revenues of $3bn in 2022 expected to more than double to almost $7bn by 2027. Competitive intensity is set to grow between global giants and newly capitalised local players. Five leading platforms – YouTube, Meta, Disney+ Hotstar, Amazon Prime Video and Netflix – will account for a combined 82% of total online video revenues in 2022.

Indonesia is Southeast Asia’s largest online video market, generating close to $1bn in revenue in 2022 with advertising contributing 62% and subscriptions 38%. The premium video sector (SVOD and premium inventory) has emerged as a material revenue generator. Five major players – Netflix, Vidio, Disney+ Hotstar, MNC Digital and Viu – will account for 75% of premium video revenue in 2022. Amazon Prime Video will expand its Indonesia SVOD service after August 2022.

Thailand’s online video industry is forecast to generate $809m in revenue in 2022. Thailand’s accessible and sizeable content creation ecosystem has historically had stronger production values than other Southeast Asian markets, positioning the market for a potentially transformational period as streamers such as Netflix, Disney+ Hotstar, WeTV, Viu and others scale local content investment.

The total addressable market (TAM) for high-speed broadband continues to expand rapidly in the Asia Pacific with greater 4G, 5G and fibre-enabled connectivity. Ex-China, combined 4G and 5G users will reach 78% of the population across APAC in 2022 while fibre-driven fixed broadband penetration will reach 31%. Telcos, connected TV (CTV) operators and pay-TV operators remain important aggregators of SVOD, freemium and AVOD services, contributing between 20-80% to OTT video platform reach, depending on the market.

According to MPA analysis, 20 online video platforms will account for 67% of the total APAC online video revenue pie.

YouTube leads with an estimated 42% share of the APAC ex-China AVOD pie in 2022. Meta Video is also sizable. In the global SVOD category in APAC, Netflix, Disney and Amazon lead.

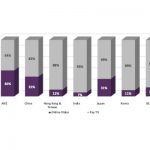

According to MPA, the three players will have a 56% share in aggregate of the APAC ex-China SVOD pie in 2022 with Netflix at 33%; Amazon Prime Video at 12%; and Disney+ (including Disney+ Hotstar) at 11%.

Netflix established an early lead given its launch and expansion in APAC after 2015-16 and success with premium Korean and Japanese content in particular. Its share of revenues has declined however from 35% in 2021. Disney+ and Disney+ Hotstar services are building scale, local content investment and monetization in markets such as Australia, India, Indonesia, and Thailand while also expanding in high ARPU, and strong local markets such as Japan. A third of revenues come from India however, where it has recently lost digital rights to the highly successful IPL cricket franchise to Viacom18. Prime Video leads the Japan SVOD category while also growing rapidly in India and is now set to expand in key Southeast Asia markets in Q4 2022.

In Southeast Asia, Viu is a major proxy for premium advertising growth and a freemium business model. Ad-supported SVOD models will launch across the Asia Pacific in 2023-24, led by Netflix and Disney+.

In India, new local players with deep pockets are gearing up to grab market share, led by a newly recapitalised Viacom18, backed by strategic Reliance, Bodhi Tree and Paramount while domestic incumbents Zee and Sony are merging to create a strong TV / online video business.