Earlier this year, Omdia reported that FAST revenue would triple between 2022 and 2027 to reach $12bn.

Free ad-supported streaming TV (FAST) channels will generate revenues of $6.3bn in 2023, according to new research from Omdia.

With the largest market of FAST channels, 80% of revenue is expected from the US, however, Omdia’s exclusive research has revealed that the UK, Canada, and Australia are major growth contenders with rapid expansion expected over the next four years.

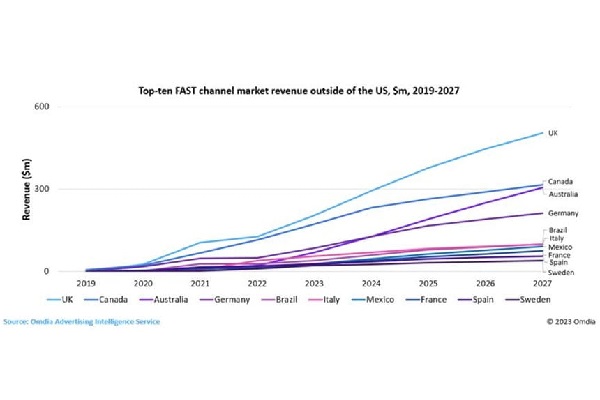

Omdia’s latest research has delved further to reveal that the UK, Canada, Australia, Germany, Brazil, Italy, Mexico, France, Spain, and Sweden are the top ten non-US markets poised for growth. While the US will continue to dominate the market, a $1.6bn revenue opportunity will emerge for FAST channels outside of the US by 2027.

Commenting on the findings of the report, Maria Rua Aguete, Senior Director at Omdia, said: “Although three of the five-largest FAST markets are English-speaking nations, Canada, Germany, and Brazil, in third, fourth and fifth place, respectively, will offer mainstream FAST opportunities for non-English content.”

Earlier this year, Omdia reported that FAST revenue grew almost 20 times between 2019 and 2022, and is set to triple between 2022 and 2027 to reach $12bn. Much of this growth will be driven by the US, which currently accounts for almost 90% of the global FAST channel market value. By 2027, the US FAST channel market will exceed $10bn in revenue.

The UK and Canada, which enjoy a significant overspill of content from the US, will have FAST markets worth over $500m and $300m, respectively, by 2027. Meanwhile, Omdia forecasts that FAST channels in Germany will generate just over $200m in the same year, while those in Brazil will hit revenues of $100m – representing around half of the total Latin American FAST market, which will be worth $207m in 2027. FAST revenue in Mexico will be $93m in 2027, making it the seventh-largest individual FAST market.

Rua Aguete concluded: “$12bn in revenues for FAST channels is impressive, but when viewed in the wider context of online video, social video remains the growth story for the next five years. FAST channels are another window to monetise content but not the only one.”