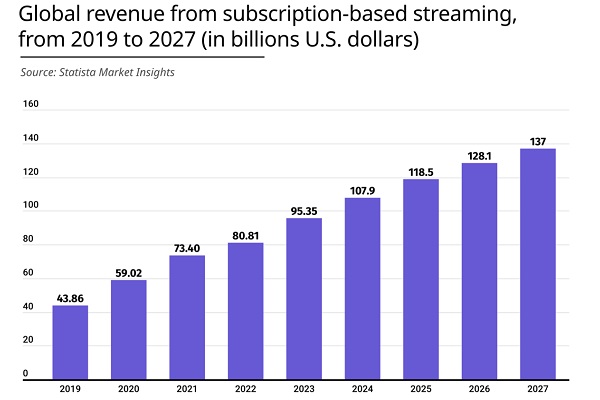

In 2023, subscription-based streaming revenue is expected to reach $95.3bn, up 18% from 2018.

Global streaming revenues are expected to grow at an average rate of 9.5% between 2023 and 2027 and hit $137bn worldwide, according to the latest data by OnlyAccounts.io.

The number of people using subscription-based streaming services has nearly doubled, jumping from 610m in 2017 to 1.16bn last year.

According to data, the global subscription-based streaming revenue is expected to hit $95.3bn in 2023, 18% more than last year. This figure is forecasted to jump by another 73% in the next four years and hit $137bn in 2027.

Global revenue from subscription-based streaming has almost tripled since 2017, topping $80bn in 2022, according to Statista Market Insights. Physical format sales dropped by nearly 30% in this period, while digital pay-per-view and paid downloads have grown much slower than streaming.

The Statista survey showed nearly 65% of total SVOD revenue comes from only three countries. The United States, as the largest SVOD market globally, will generate $39.2bn in revenue this year, and continue growing by a CAGR of 8.6% between 2023-2027, resulting in a projected market volume of $54.6bn.

As the second-largest globally, the Chinese market will see an average growth rate of 10.1% in this period, with SVOD revenues rising from $19.4bn to $28.5bn. The United Kingdom follows, with almost $5.5bn in revenue by 2027 and a four-year CAGR of 8.9%.

The “streaming wars“ between the media giants Netflix, Apple, Amazon, and Hulu have pushed the media industry’s content cash spending to record highs. Over the past five years, media companies splashed out close to $445bn on video content in five years, all in a race to grow their viewership.

According to the latest Statista forecasts from May, around 1.3bn people worldwide will watch SVOD videos this year, up from 1.16bn in 2022, with the United Kingdom, China, and the United States as the top three markets. In these developed digital markets, consumers continue switching away from traditional pay-TV consumption in favour of more flexible, affordable, and expansive video formats.

Statista expects the number of users to continue growing in the following years and hit 1.5bn in 2025. By 2027, this figure is forecasted to grow by another 9% and hit 1.64bn worldwide.