According to the report, satellite demand is experiencing sustained growth driven by NGSO constellations, while GEO comsat demand is rebounding with smaller assets.

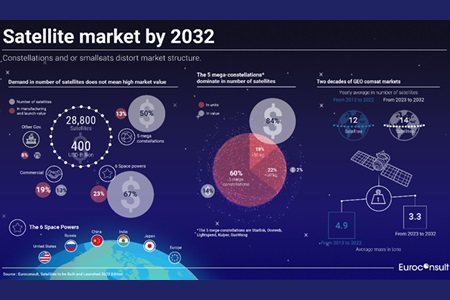

In a report titled “Satellites to be Built and Launched,” Euroconsult revealed a staggering annual average of more than 2,800 satellites launched between 2023 and 2032. This equates to eight satellites launched per day, totalling a mass of four tons. The report sheds light on critical aspects shaping the satellite market’s long-term trajectory, emphasising sustained demand, the dominance of NGSO constellations, and seismic shifts driven by mega-constellations. A particular focus is placed on the short-term challenges faced by established vendors.

In a report titled “Satellites to be Built and Launched,” Euroconsult revealed a staggering annual average of more than 2,800 satellites launched between 2023 and 2032. This equates to eight satellites launched per day, totalling a mass of four tons. The report sheds light on critical aspects shaping the satellite market’s long-term trajectory, emphasising sustained demand, the dominance of NGSO constellations, and seismic shifts driven by mega-constellations. A particular focus is placed on the short-term challenges faced by established vendors.

Commercial NGSO constellations, renowned for their advanced capabilities and size, are reshaping satellite manufacturing and deployment to meet the global demand for connectivity. Despite constituting 65% of satellite demand, they contribute only 18% to the manufacturing and launch value, averaging $10.5bn annually. In contrast, GEO comsats average $3.4bn. Euroconsult forecasts a moderate increase in GEO comsat demand, surpassing past decade levels, with an average of 14 orders annually by 2032. This shift underscores the decline in the broadcasting business and the growing emphasis on scalable solutions for the expanding broadband market.

The report also highlights a robust and sustained demand for satellites from legacy customers, with civil and defence government operators alone holding three-quarters of the yearly average market value of $58bn for manufacturing and launch. The six leading space-faring governments or organisations (US, China, Russia, Japan, India, and European governments, EU, and ESA) are expected to account for two-thirds of the total satellite manufacturing and launch demand in value, emphasizing the significance of market value beyond raw numbers.

Maxime Puteaux, Space Industry Practice Leader at Euroconsult and editor of the report stated: The increasing concentrated demands for satellites by a handful of new customers, coupled with high pressure on their cost structures and internalized supply chains, is reshaping market dynamics and placing vendors margins under pressure. The scarcity of launches and the dependency of Western launch customers on SpaceX create a market concentration which will have long-term effects on the industry.

The report delves into the short-term bottleneck faced by established vendors gearing up to introduce next-generation launchers. Challenges in this transitional phase are explored in-depth, providing stakeholders with crucial insights into the lasting impact on the market and downstream effects. The report also addresses the dominance of SpaceX, its de facto monopoly, and the implications as competitors’ next-generation launchers become operational, shaping industry dynamics significantly.

Notably, the “Satellites to be Built & Launched” report includes a refined pricing model for manufacturing and launch prices, considering inflation-driven cost and price increases witnessed and anticipated in the industry. It incorporates new content to provide decision-makers with updated forecasts, accounting for the economic situation, ongoing supply chain tensions, and changes in the macro-economic environment.

The report’s satellite forecast relies on a comprehensive assessment of downstream markets, satellite operators’ strategy and maturity, and potential new players. Euroconsult applies discount factors to known projects based on credibility, emphasising that constellation-related figures are derived from Euroconsult’s assumptions and may not necessarily reflect operators’ views.